Applying for a Schengen Visa? Securing compliant travel insurance is not just a formality—it’s a mandatory requirement under European Union regulations. This crucial step ensures you’re financially protected against unforeseen medical expenses during your travels within the Schengen Area. Without the right insurance, your visa application could face rejection.

Understanding Schengen Visa Medical Insurance

Schengen travel insurance is a specific type of health insurance policy designed for individuals applying for a Schengen Visa. It acts as a financial safety net, covering emergency medical treatment, hospitalization, and even medical repatriation should the unexpected occur during your Schengen journey. Meeting these insurance requirements is non-negotiable; it’s a fundamental part of the Schengen Visa application process.

This insurance is meticulously crafted to meet the stringent requirements set forth in the official Schengen Visa code. It’s not merely recommended—it’s a legal prerequisite, ensuring both your well-being and compliance with international travel standards.

Crucial Reminder: Your travel insurance must strictly adhere to EU guidelines. Non-compliant policies are a common cause of visa application denials. Always verify policy compliance with your insurer or the relevant embassy before submitting your application.

Explore Schengen-Compliant Insurance Options Now!

Travel Medical Insurance policies that fulfil Schengen Visa requirements

Travel Medical Insurance policies that fulfil Schengen Visa requirements

Schengen Visa Insurance: Key Requirements Explained

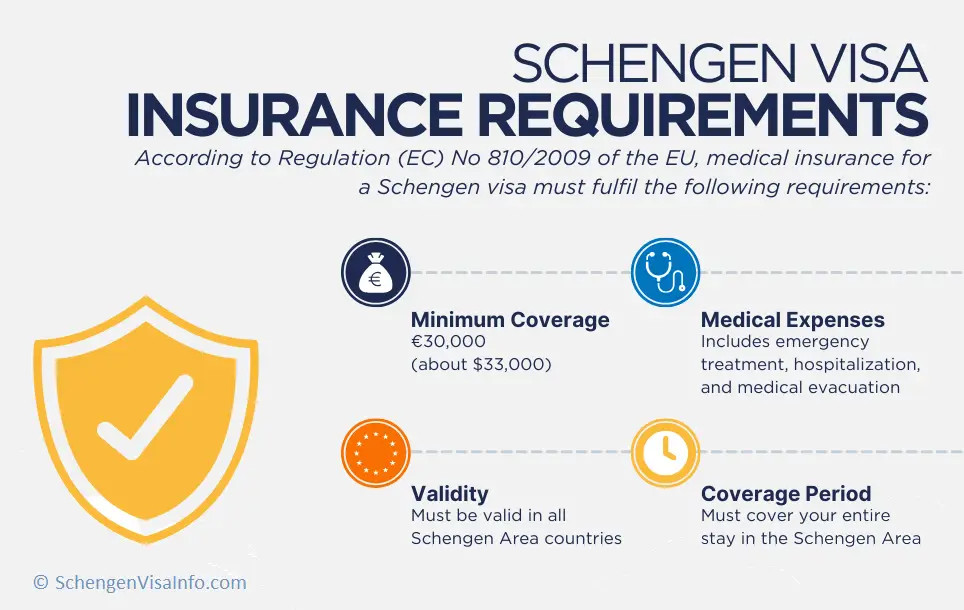

To be deemed valid for your Schengen Visa application, your travel insurance must fulfill several key criteria as dictated by EU regulations:

- Minimum Coverage: A minimum medical coverage of €30,000 is mandatory. This ensures substantial financial backing for medical emergencies.

- Schengen Area Validity: The insurance policy must be valid across all Schengen member states, not just your primary destination.

- Duration of Stay: Coverage must span your entire intended stay within the Schengen Area, from your arrival to departure date.

- Comprehensive Coverage: Essential coverage includes medical repatriation, emergency medical treatment, and hospital expenses.

While travel health insurance is a prudent choice for any traveler to Europe, it’s legally mandatory only for those requiring a Schengen Visa. This includes travelers from countries without visa-free agreements with the Schengen Area, regardless of their purpose of visit—be it tourism, business, study, or any other reason. For these visa applicants, comprehensive coverage for the entirety of their European stay is indispensable.

Travelers from visa-exempt countries visiting Europe have the option to purchase European travel insurance for enhanced security and peace of mind, although it is not a mandatory requirement for entry. For competitive quotes and compliant plans, explore reputable providers such as Europ Assistance or AXA Assistance.

Why is Travel Insurance a Must for Schengen Visa Applications?

The mandate for travel insurance is rooted in Regulation (EC) No 810/2009, a cornerstone of the European Parliament and Council enacted on July 13, 2009, and effective since April 5, 2010. This regulation explicitly states:

“… Applicants for a uniform visa for one or two entries shall prove that they own adequate and valid travel medical insurance to cover any expenses which might arise in connection with repatriation for medical reasons, urgent medical attention, and/or emergency hospital treatment or death, during their stay(s) on the territory of the Member States. The insurance shall be valid throughout the Schengen Area Member States territory and cover the entire period of the person’s intended stay or transit. The minimum coverage shall be EUR 30,000” (…)

This legal framework ensures that visitors to the Schengen Area have access to necessary medical care without placing a financial burden on the host countries’ healthcare systems. It’s a reciprocal agreement designed to protect both travelers and the Schengen nations.

Who Needs Schengen Visa Medical Coverage?

If you hold a passport from any of the nations listed below, securing medical coverage is a prerequisite for your Schengen Visa application:

- Afghanistan, Algeria, Angola, Armenia, Azerbaijan, Bahrain, Bangladesh, Belarus, Belize, Benin, Bhutan, Bolivia, Botswana, Burkina Faso, Burma/Myanmar, Burundi, Cambodia, Cameroon, Cape Verde, Central African Republic, Chad, China, Comoros, Congo, Côte d´Ivoire, Cuba, Democratic Republic of Congo, Djibouti, Dominican Republic, Ecuador, Egypt, Equatorial Guinea, Eritrea, Eswatini, Ethiopia, Fiji, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Guyana, Haiti, India, Indonesia, Iran, Iraq, Jamaica, Jordan, Kazakhstan, Kenya, Kuwait, Kyrgyzstan, Laos, Lebanon, Lesotho, Liberia, Libya, Madagascar, Malawi, Maldives, Mali, Mauritania, Mongolia, Morocco, Mozambique, Namibia, Nauru, Nepal, Niger, Nigeria, North Korea, Oman, Pakistan, Papua New Guinea, Philippines, Qatar, Russia, Rwanda, Sao Tome and Principe, Saudi Arabia, Senegal, Sierra Leone, Somalia, South Africa, South Sudan, Sri Lanka, Sudan, Suriname, Syria, Tajikistan, Tanzania, Thailand, Togo, Tunisia, Turkey, Turkmenistan, Uganda, Uzbekistan, Vanuatu, Vietnam, Yemen, Zambia, Zimbabwe.

If your nationality is not listed above, you are generally exempt from mandatory medical insurance for short trips to the Schengen Area, unless you have previously been denied visa-free entry and are now required to apply for a visa. It’s always advisable to check the specific requirements of the embassy or consulate where you are applying.

Choosing the Right Schengen Travel Insurance Plan

Selecting the ideal Schengen visa insurance plan necessitates careful consideration. Prioritize providers that are officially licensed and recognized by EU/Schengen embassies and consulates. Meticulously verify that the policy comprehensively meets all stipulated requirements. Failure to comply with these standards can unfortunately lead to visa rejection. A thorough review of your policy details is therefore not just recommended, but essential.

In 2023 alone, Schengen consulates globally turned down a significant 1,632,984 visa applications, underscoring the critical need for meticulous adherence to all prerequisites, including possessing Schengen-compliant travel coverage. (Source: European Commission). This statistic highlights that even seemingly minor oversights can have significant consequences for your visa application.

Compare and Get Free Quotes for Schengen Insurance

Streamline your search by browsing and comparing Schengen travel visa insurance options from reputable and trusted providers. Consider leading insurers like AXA, Europ Assistance, Allianz, and Mutuaide. These providers offer plans specifically engineered to satisfy Schengen visa mandates and are universally accepted by all Schengen/EU embassies and consulates worldwide.

These providers also offer the added benefit of instant certificate downloads upon purchase. This ensures you possess all the necessary documentation promptly, streamlining your Schengen visa application process.

Compare Schengen Visa Insurance Plans Now to find a plan that not only aligns with your budget and travel needs but also guarantees full compliance with EU regulations, thereby safeguarding your visa application.

Europ Assistance Schengen: Detailed Plan Overview

- Medical Assistance: Up to €30,000 for illness or injury related expenses.

- Deductible: No deductible, ensuring you are covered from the first euro.

- Geographical Scope: Valid throughout the entire Schengen Area.

- Starting Cost: From just €3 per day, offering affordable coverage.

Plan Details: Europ Assistance Schengen Get a Quote: Europ Assistance Schengen

AXA Schengen Low Cost: Budget-Friendly Coverage

- Coverage Amount: Medical expenses coverage up to €30,000.

- Coverage Area: Schengen Zone wide coverage.

- Starting Price: From a competitive €5.

- Deductible: Zero deductible for immediate coverage.

- Visa Refusal Refund: Policy refund in case of visa denial, offering financial security.

- 24/7 Telemedical Consultation: Access to medical advice anytime, anywhere.

Plan Details: AXA Schengen Low Cost Get a Quote: AXA Schengen Low Cost

Europ Assistance Schengen Plus: Enhanced Coverage Options

- Increased Assistance: Medical assistance coverage up to €60,000 for more extensive protection.

- Expanded Coverage Area: Covers not only the Schengen Area but also Cyprus and Ireland.

- Deductible: No deductible for comprehensive coverage from the start.

- Starting Cost: From €5 per day, offering excellent value for expanded coverage.

- Companion Benefits: Includes return/relocation and lodging expenses for a travel companion in case of emergencies.

Plan Details: Europ Assistance Schengen Plus Get a Quote: Europ Assistance Schengen Plus

Mutuaide

Mutuaide

Mutuaide Basic: Worldwide Coverage at a Competitive Price

- Global Medical Coverage: Medical expenses coverage abroad up to €30,000, valid worldwide.

- Coverage Area: Worldwide, offering broader protection beyond Schengen.

- Starting Price: From just €3.00 per day for a 10-day trip, highly cost-effective.

- Deductible: €0 deductible for immediate claim access.

- Validity: Single trip policy.

- Sports Coverage: Includes search and rescue costs for sports-related incidents.

Plan Details: Mutuaide Basic Get a Quote: Mutuaide Basic

Allianz Serenity: Comprehensive Plan with Added Benefits

- Coverage Level: Medical expenses coverage up to €30,000.

- Starting Cost: From €7 per day for a 7-day trip.

- Deductible Options: Deductible ranging from €30 to €100, offering flexibility in premiums.

- Additional Insurance: Includes luggage insurance for travel convenience.

- Sports Coverage: Covers search and rescue costs for sports-related emergencies.

Plan Details: Allianz Serenity Get a Quote: Allianz Serenity

Are you a budget-conscious traveler? Explore Low-Cost Schengen Visa Insurance Plans designed to provide necessary coverage without breaking the bank.

Traveling and over 75 years old? Discover Schengen visa health insurance plans for seniors, offering specialized protection tailored to the needs of senior travelers for a worry-free journey.

Obtaining and Submitting Your Schengen Insurance Certificate

Once you’ve finalized the purchase of a Schengen-compliant health insurance policy, the insurance provider will issue an official certificate of insurance. This document is your formal proof of coverage and is a mandatory inclusion in your Schengen Visa application dossier.

Essential Information on Your Insurance Certificate

Your Schengen medical insurance certificate must clearly and comprehensively display the following critical information:

- Insurance Provider Details: Full name and contact information of the insurance company.

- Policy Specifics: Your unique policy number and precise details of the coverage provided.

- Geographical Validity: Explicit confirmation that your policy is valid and effective throughout the entire Schengen Area.

- Personal Identification: Your full name, passport number, and other personal identifiers to link the policy to you.

- Coverage Details: Specific amounts covered for medical expenses and a clear breakdown of what medical services are included.

Schengen Insurance Certificate Examples

These examples provide a visual guide to help you understand what a compliant Schengen medical insurance certificate should look like, ensuring it meets all necessary visa requirements and avoids potential issues during your application.

Europ Assistance Certificate Example

Learn more about Europ Assistance.

AXA-Schengen Certificate Example

Learn more about AXA.

How to Submit Your Schengen Insurance Proof

You are required to submit your proof of Schengen travel insurance along with all other necessary visa application documents. Schengen embassies typically accept submissions through these methods:

1. In-Person Submission

Many Schengen consulates mandate in-person submission of all visa application materials, including your Schengen travel insurance certificate. In such cases, you will need to locate the embassy of your intended primary destination country and schedule an appointment to personally deliver your documents.

Important Note: Some embassies specifically require an original, physical copy of your Schengen visa insurance certificate. Always check the specific requirements of the embassy you are applying to.

2. Online Submission

Certain Schengen countries offer the convenience of online document submission, including your insurance certificate. In these instances, you will typically upload a digital copy of your certificate (often in PDF format) via the designated application portal. Most online insurance purchases provide an electronic copy of your certificate via email immediately after purchase.

Keep in Mind: Even with online submission, you may still need to present physical copies of your documents, including your medical insurance certificate, when you attend your in-person appointment for biometric data collection at the embassy.

3. Postal Submission

Less commonly, some Schengen embassies or consulates may allow document submission by postal mail. If this option is available, they will usually provide specific instructions on how to organize your documents, and your insurance certificate will likely be placed in a specific order within the submission package.

Critical Step: Always verify the precise submission method and any specific document requirements directly with the relevant embassy or consulate to ensure your application complies with their guidelines.

It is also highly recommended by Schengen embassies that you carry a copy of your insurance policy with you throughout your travels within the Schengen Area. This allows you to readily provide proof of insurance to border control or other authorities if requested.

Is Schengen Medical Insurance Valid in All Schengen Countries?

Yes, to be valid for visa purposes, your Schengen travel insurance policy must provide coverage across all Schengen member states. The Schengen Area comprises the following countries:

- Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland.

Ensure your policy explicitly lists all Schengen countries within its geographical coverage to guarantee acceptance by consulates and validity throughout your travels.

Cost of Schengen Travel Insurance: Factors and Affordability

Schengen travel health insurance is generally quite affordable. Policies for a one-week trip can start as low as €18. However, the ultimate cost of your Schengen medical insurance is influenced by several key factors:

- Age of the Traveler: Older travelers may face slightly higher premiums due to increased risk factors.

- Coverage Level: Plans with higher coverage limits or additional benefits will typically cost more.

- Trip Duration: The length of your stay directly impacts the overall premium. Longer trips will naturally require more extended coverage and thus, higher costs.

- Insurance Provider: Pricing can vary between different insurance companies, so comparing quotes is always advisable.

In 2023, over 15 million Schengen visas were issued. Each applicant was required to demonstrate valid insurance coverage, highlighting the widespread need for this essential travel document, as mandated by EU regulations (Source: European Commission).

Utilizing Comparison Websites for Schengen Insurance Purchases

Travel insurance comparison websites are invaluable resources that allow you to efficiently compare and purchase policies from a multitude of providers in one place. These platforms act as brokers, connecting you with various insurance companies and streamlining the selection process.

Important Clarification: Comparison websites themselves do not underwrite or offer travel insurance policies directly. Instead, they function as intermediaries, selling insurance plans offered by partner insurance companies. They typically have established agreements with specific insurers and present the plans offered by these partners.

Are Schengen Insurance Comparison Sites Reliable?

Generally, yes. Many insurance comparison sites, especially well-established platforms like Insurte, are legitimate and offer a trustworthy way to find suitable Schengen insurance.

However, it’s important to exercise caution as insurance scams do exist and can be deceptively sophisticated.

Here are essential tips to help you discern legitimate travel medical insurance comparison sites from potential scams:

- Verify Insurance Company Reputations: Carefully examine the insurance companies whose plans are featured on the comparison site. Utilize resources like A.M. Best Rating to check the financial strength ratings and legitimacy of these insurers.

- Website Scrutiny: Thoroughly review the comparison site itself. Look for essential details such as clear terms and conditions, a transparent privacy policy, and licensing or registration information, which reputable sites will prominently display.

- Client Reviews: Seek out reviews from previous customers. Platforms like Reddit, TrustPilot, or Google Reviews can offer valuable insights into the experiences of other users and the site’s reliability.

- Beware of “Too Good to Be True” Deals: Exercise skepticism towards deals that appear drastically cheaper or offer significantly more coverage for the price. In the realm of online travel insurance, exceptionally low-priced offers should be approached with caution and investigated further.

Schengen Insurance Comparison Sites: Advantages and Disadvantages

Here’s a balanced view of the pros and cons of using comparison sites for your Schengen insurance needs:

| Pros | Cons |

|---|---|

| Streamlined and quick purchasing process. | Limited selection of insurance plans compared to the entire market. |

| Ability to compare multiple plans side-by-side. | Customization options may be less extensive. |

| Potential access to additional services, such as Schengen visa invitation letters. |

What Does Schengen Medical Insurance Typically Cover?

A comprehensive travel health insurance policy for the Schengen Area should provide coverage for the following essential medical situations and expenses:

- Emergency Medical Care: Coverage for accidents or sudden illnesses occurring within the Schengen Area.

- Emergency Evacuation: Costs associated with medically necessary evacuation.

- Repatriation of Remains: Expenses related to the repatriation of remains in case of death.

- Return of a Minor: Coverage for the return travel costs of a minor if left unattended due to a medical emergency of the accompanying adult.

- Accidental Death/Disability Benefit: Compensation in case of accidental death, injury, or permanent disability.

- Overseas Funeral Expenses: Contribution towards funeral expenses incurred abroad.

- Dental Emergencies: Coverage for urgent dental care needs.

- Pregnancy-Related Expenses: Many insurers cover pregnancy-related expenses, especially if travel occurs during the first trimester. Coverage beyond this point can vary, so policy details should be checked.

COVID-19 Coverage Requirements for Schengen Travel

For up-to-date information on COVID-19 related coverage requirements for Schengen travel insurance, refer to specific guidelines as they may evolve. It’s advisable to check for policies that explicitly include coverage for COVID-19 related medical expenses and potential trip disruptions. Learn more about COVID-19 Coverage Requirements.

Common Exclusions and Optional Add-ons in Schengen Insurance

While Schengen travel insurance offers broad protection, certain situations are typically excluded, or may require optional add-on coverage:

- Pre-existing Conditions: Generally, policies do not cover pre-existing medical conditions (like asthma or diabetes) unless an acute onset or emergency related to the condition occurs unexpectedly. Consider specific riders for pre-existing condition coverage if needed.

- Risky Sports: Participation in high-risk sports (e.g., skiing, scuba diving, mountaineering) is often excluded from standard policies. Supplementary coverage for adventure sports can be purchased.

- High-Risk Destinations: Travel to countries considered high-risk due to war, natural disasters, or terrorism may be excluded. Check policy exclusions regarding destination risks.

- Acute Onset of Pre-existing Conditions: While pre-existing conditions themselves are often excluded, some policies offer coverage for the sudden and unexpected acute onset of a pre-existing condition. This is important for travelers with known health concerns.

Understanding Travel Medical Insurance

Travel medical insurance is specifically designed to cover medical expenses arising from injury or unexpected illness during your travels. The necessity of travel health insurance depends on your destination and your ability to handle potential healthcare costs abroad.

However, for many travelers, especially seniors, those with pre-existing conditions, or those visiting less-developed regions, travel medical protection is essential.

Beyond medical expenses, comprehensive travel insurance can also cover various travel-related disruptions like lost luggage, flight cancellations, or bankruptcy of travel agencies or accommodations. Some policies incorporate trip cancellation and trip interruption benefits for added security.

Whether you are a frequent traveler or taking a single trip, insurance policies can be tailored to cover the exact duration of your stay within the Schengen Area, with costs adjusted accordingly.

Typical Restrictions and Limitations in Schengen Insurance Policies

- Pre-existing Conditions (International Travel): As mentioned, standard travel insurance often excludes pre-existing conditions when traveling internationally. If you have a pre-existing condition, ensure you understand the policy’s stance on acute onsets and consider supplemental coverage.

- Sports Exclusions: Participation in extreme or high-risk sports is often excluded from standard policies.

- War Zones: Policies typically exclude coverage for injuries or medical events occurring in designated war zones or conflict areas.

- Coverage Duration Limits: Many policies have specified time limits for coverage (e.g., 60 or 90 days maximum trip duration). Costs are usually calculated based on the intended trip length.

- Self-Inflicted Injuries: Suicide or self-inflicted injuries are universally excluded from travel insurance policies.

- Substance Abuse: Medical expenses arising from substance abuse, including drugs or alcohol, are not covered.

Trip Cancellation and CFAR (Cancel For Any Reason) Benefits

While some Schengen health insurance policies may include trip interruption coverage, standard policies generally do not automatically include trip cancellation benefits. Trip interruption coverage typically reimburses costs if you must return home early due to unforeseen circumstances like a family emergency. Always confirm the specific benefits offered by your chosen provider.

Does Schengen Travel Insurance Include Trip Cancellation?

Most standard Schengen visa insurance plans are primarily designed to meet EU visa requirements, focusing on medical coverage. Therefore, trip cancellation benefits are typically not included in basic Schengen insurance plans.

To obtain trip cancellation coverage, you usually need to purchase it as an add-on or opt for a more comprehensive travel insurance policy.

Here are options to consider for securing trip cancellation benefits:

- Add-on Policy: Inquire with your Schengen insurance provider about purchasing a separate trip cancellation add-on to supplement your medical policy.

- Separate Comprehensive Policy: Consider purchasing a standalone travel insurance policy from a different provider that explicitly includes trip cancellation benefits.

- Trip Interruption Coverage (Limited Cancellation): Verify if your Schengen policy includes limited trip interruption coverage, which can reimburse expenses for returning home early due to specific unforeseen events (e.g., family emergencies, natural disasters).

Important Consideration: Adding trip cancellation or more comprehensive benefits will increase the overall cost of your insurance plan.

What Situations Does Trip Cancellation Typically Cover?

Trip cancellation benefits, when included, are usually limited to specific, significant reasons for cancellation. Common covered reasons include:

- Serious Illness or Injury: A severe health emergency preventing you from traveling to the Schengen Area.

- Family Bereavement: Death of an immediate family member before your trip.

- Natural Disasters: Major natural disasters at your destination or place of origin that directly impact your travel.

- Involuntary Job Loss: Unexpected unemployment making your trip financially unviable.

CFAR (Cancel For Any Reason) Benefits: Availability

CFAR (Cancel For Any Reason) benefits, which allow you to cancel your trip for virtually any reason and receive partial reimbursement, are not typically available with standard Schengen travel insurance policies.

CFAR is a more flexible but also more expensive add-on compared to standard trip cancellation. Because Schengen medical insurance is designed to be cost-effective and primarily focused on medical coverage to meet visa requirements, CFAR is generally not included.

If CFAR coverage is desired, you would likely need to purchase a separate, more comprehensive travel insurance policy that offers this specific benefit.

Is Trip Cancellation Coverage Worth the Extra Cost?

Whether trip cancellation coverage is worthwhile depends on the financial investment in your trip and your personal risk tolerance. Trip cancellation is most beneficial when:

- Significant Trip Costs: You have booked a non-refundable and expensive trip (flights, accommodations, tours).

- Uncertainty and Risk Aversion: You are concerned about potential unforeseen events that might force you to cancel your trip and wish to protect your investment.

For Schengen visa applications, since the primary requirement is medical insurance, and trip cancellation adds to the cost, it may not always be considered essential.

If you are concerned about potential trip cancellations, consider booking refundable travel arrangements (hotels, flights) where possible. This can provide some financial protection without the added cost of trip cancellation insurance.

If you are already in Europe and need to make an insurance claim, ensure you understand the necessary steps. Consult our detailed guide on How to Make a Claim for Schengen/Europe Travel Insurance.

Frequently Asked Questions (FAQ) About Schengen Visa Insurance

Do Family Members of EU/EEA Nationals Need Travel Insurance?

In certain specific situations, as outlined in Directive 2004/38/EC of the European Parliament, immediate family members of EU/EEA nationals may be exempt from the travel insurance requirement when applying for a Schengen Visa. These conditions include:

- Accompanying or Joining an EU/EEA National: The family member must be traveling with or joining the EU/EEA national in the Schengen Area.

- Financial Dependency: The family member may need to demonstrate financial dependence on the EU/EEA national.

- Specific Family Relationships: Exemptions typically apply to spouses, registered partners, dependent children (under 21 or older if dependent), and dependent parents.

Should I Choose a Schengen Insurance Policy With a Zero Euro Deductible?

While not strictly mandatory, opting for a policy with a zero EUR deductible is strongly recommended. A zero-deductible policy ensures that you receive full coverage from the first euro of eligible medical expenses, eliminating any out-of-pocket payments at the point of service. This can provide greater peace of mind and reduce the risk of visa application complications related to insurance coverage.

Are Diplomatic Passport Holders Exempt From Schengen Insurance Requirements?

Yes, holders of diplomatic passports are indeed exempt from the mandatory Schengen travel medical insurance requirement. They are not obligated to provide proof of insurance when traveling to the Schengen Area.

Is Health Coverage Required for Seafarers Traveling to the Schengen Area?

No, travel medical insurance is generally not mandatory for seafarers traveling to the Schengen Area in a professional capacity. Seafarers are typically exempt from this requirement due to their existing medical coverage arrangements provided through their employment and maritime activities.

What If I’m Applying for a Schengen Multiple-Entry Visa?

According to Regulation (EU) 2019/1155, when applying for a Schengen multiple-entry visa, you are required to demonstrate that you possess sufficient and valid travel medical insurance to cover the duration of your first intended trip.

However, it’s crucial to understand that you must maintain valid and compliant Schengen travel insurance for each subsequent trip to the Schengen Area using your multiple-entry visa. Continuous coverage is necessary for every visit.

Is European Medical Insurance Necessary for Students or Work Visa Applicants?

Yes, if you are applying for a short-term Schengen visa for purposes such as study, work, or business, you are required to have valid travel insurance that meets Schengen requirements. For long-term visas (e.g., for extended study or permanent residency), the insurance rules and requirements may differ, often requiring local health insurance coverage within the Schengen country.

Do Minors Need Schengen Medical Protection?

Yes, children and minors applying for a Schengen visa are also subject to the travel health insurance requirement. Insurance must be arranged for them, typically by their parents or legal guardians, and the policy must fully comply with all Schengen visa insurance regulations.

More Helpful Guides for Schengen Travel

Explore these additional resources for more in-depth information related to Schengen visas and travel insurance:

France Visa Insurance, Spain Visa Insurance, Europe Medical Insurance for US Citizens, Schengen Travel Health Insurance UK, Greece Visa Insurance, Applying for a Schengen Visa from the U.S., Applying for a Schengen Visa from the UK, Everything You Need to Know About European Healthcare and Health Insurance

Did you find this page helpful?

Yes No