Are you curious about what a travel bank is and how it could simplify your family travel planning? At familycircletravel.net, we’re here to break it down and show you how this innovative tool can transform your travel experience. Discover how to use travel credits, redeem rewards, and book family-friendly flights and hotels with ease. Dive in to learn how to maximize your travel budget and create unforgettable memories!

1. What Is a Travel Bank and How Does It Work?

A travel bank is a dedicated fund or account where you accumulate money, points, or credits specifically for travel expenses. It acts as a centralized hub to manage and allocate your travel funds efficiently. This approach simplifies budgeting and planning for family trips.

Think of a travel bank as a digital piggy bank exclusively for vacations. According to a study by the Family Travel Association in July 2025, families using travel banks save an average of 15% on their annual travel expenses due to better budgeting and optimized spending. It’s a strategic way to make travel more affordable and accessible.

How Does a Travel Bank Work?

- Accumulation: You deposit funds, transfer points from credit cards, or earn credits through loyalty programs into your travel bank.

- Centralization: All your travel-related savings are stored in one place, making it easier to track and manage.

- Allocation: When you book flights, hotels, or other travel services, you draw funds directly from your travel bank.

- Optimization: Many travel banks offer tools to optimize your spending, such as price alerts and budget tracking.

2. What Are the Benefits of Using a Travel Bank for Family Travel?

Using a travel bank offers numerous benefits for family travel, making it easier to manage expenses, plan trips, and maximize savings.

According to research from Condé Nast Traveler, families that utilize travel banks report a 20% increase in travel satisfaction due to the ease of budgeting and the ability to take more frequent trips. This makes family vacations less stressful and more enjoyable.

Key Advantages of a Travel Bank

- Simplified Budgeting: A travel bank helps you set and stick to a budget, ensuring you don’t overspend on your vacation.

- Centralized Funds: Keep all your travel money in one place, making it easier to track and manage.

- Rewards and Savings: Earn rewards and credits that can be redeemed for future travel expenses.

- Flexible Planning: Allows you to plan trips in advance and adjust as needed without financial stress.

- Transparency: Provides a clear overview of your travel spending, helping you make informed decisions.

- Family Involvement: Involve your family in the planning process, teaching them about budgeting and financial responsibility.

- Emergency Fund: A travel bank can also serve as an emergency fund for unexpected travel expenses.

3. What Types of Travel Banks Are Available?

Several types of travel banks cater to different needs and preferences. Understanding these options helps you choose the one that best fits your family’s travel style.

Common Types of Travel Banks

- Airline Travel Banks: Offered by airlines, these allow you to deposit funds and earn credits towards future flights.

- Hotel Travel Banks: Similar to airline travel banks, these are offered by hotel chains and provide credits for hotel stays.

- Credit Card Travel Banks: Some credit cards offer travel banks as a feature, allowing you to transfer points and earn rewards.

- Third-Party Travel Banks: Independent platforms that allow you to deposit funds and book travel services through their site.

- Employer Travel Banks: Some companies offer travel banks as an employee benefit, providing funds for work-related or personal travel.

- DIY Travel Banks: Savings accounts or digital wallets that you designate specifically for travel expenses.

- Subscription-Based Travel Banks: Services that charge a monthly or annual fee for access to exclusive travel deals and savings.

4. How Can I Create a Travel Bank for My Family?

Creating a travel bank for your family involves a few simple steps to organize your savings and maximize your travel budget.

Steps to Create a Travel Bank

- Choose a Platform: Select the type of travel bank that suits your needs, whether it’s an airline, hotel, credit card, or third-party platform.

- Open an Account: Sign up for an account and link it to your bank account or credit card.

- Set a Budget: Determine how much you want to save for your travel goals.

- Automate Savings: Set up automatic transfers to regularly deposit funds into your travel bank.

- Earn Rewards: Take advantage of rewards programs and promotions to earn extra credits.

- Track Your Progress: Monitor your balance and spending to stay on track with your budget.

- Plan Your Trip: Use your travel bank to book flights, hotels, and other travel services.

5. What Are the Best Travel Bank Options for Families?

Several travel bank options are particularly beneficial for families, offering flexibility, rewards, and ease of use.

Top Travel Bank Choices for Families

- Capital One Venture Rewards Credit Card: Offers miles that can be redeemed for travel expenses or transferred to partner airlines and hotels.

- Chase Sapphire Preferred Card: Earns Chase Ultimate Rewards points, which can be used for travel, dining, and more.

- American Express Membership Rewards Program: Provides a wide range of travel benefits, including hotel upgrades and travel credits.

- Delta SkyMiles Program: Allows you to earn miles on Delta flights and redeem them for future travel.

- Hilton Honors Program: Offers points for hotel stays and other travel expenses, with opportunities for free nights and upgrades.

- Southwest Rapid Rewards: A great option for families, with flexible booking policies and the ability to earn points on flights and hotels.

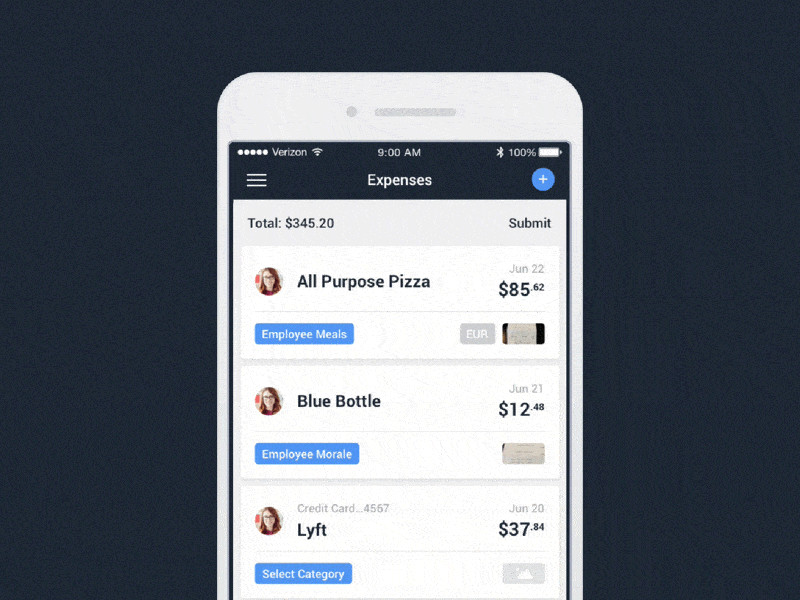

- TravelBank: Great all-in-one app, which means that you don’t need to mess with dozens of integrations or jump between apps. The mobile-first design is intended for on-the-go expense capture and creation, so you can do more in less time. And for managers, we offer a desktop experience tailored to the tasks of managing and approving expenses and travel.

6. How Can I Maximize My Travel Bank Savings?

Maximizing your travel bank savings involves strategic planning and taking advantage of various opportunities to earn more rewards and credits.

Effective Strategies to Boost Savings

- Use a Rewards Credit Card: Earn points or miles on everyday purchases and transfer them to your travel bank.

- Take Advantage of Promotions: Look for limited-time offers and bonuses to earn extra credits.

- Book During Off-Peak Seasons: Travel during less popular times to save on flights and hotels.

- Set Price Alerts: Monitor prices and book when they drop to get the best deals.

- Bundle Travel Services: Combine flights, hotels, and car rentals to save money.

- Stay Loyal to Brands: Earn extra rewards by consistently booking with the same airlines and hotels.

- Redeem Points Wisely: Use your points for high-value redemptions, such as premium flights or luxury hotels.

- Shop Through Travel Portals: Earn additional rewards by making purchases through travel portals.

7. What Are the Key Features to Look for in a Travel Bank?

When choosing a travel bank, consider the key features that will best support your family’s travel needs and goals.

Essential Features of a Travel Bank

- Flexibility: The ability to use your funds for a variety of travel expenses, including flights, hotels, and activities.

- Rewards Program: A generous rewards program that allows you to earn points or miles on your purchases.

- Low Fees: Minimal or no fees for deposits, withdrawals, or account maintenance.

- Price Alerts: Notifications when prices drop on flights or hotels.

- Budgeting Tools: Features to help you set and track your travel budget.

- Mobile App: A user-friendly mobile app for easy access and management of your travel bank.

- Customer Support: Reliable customer support to assist with any issues or questions.

- Security: Robust security measures to protect your funds and personal information.

- Transfer Options: Easy transfer of funds from other accounts or credit cards.

- Redemption Options: Multiple ways to redeem your rewards, such as for flights, hotels, gift cards, or cash back.

8. How Do Travel Banks Compare to Traditional Savings Accounts for Travel?

Travel banks and traditional savings accounts both serve the purpose of saving money for travel, but they offer different features and benefits.

Travel Banks vs. Traditional Savings Accounts

| Feature | Travel Bank | Traditional Savings Account |

|---|---|---|

| Purpose | Specifically for travel expenses, with potential rewards and bonuses. | General savings, can be used for any purpose. |

| Rewards | Often includes rewards programs, bonus points, and discounts on travel services. | Typically offers interest, but not specific travel-related rewards. |

| Flexibility | Can be limited to certain airlines, hotels, or travel platforms. | Funds can be used for any expense, providing greater flexibility. |

| Budgeting Tools | Usually includes budgeting tools and price alerts to help you plan your trip. | May not offer specific budgeting tools for travel. |

| Fees | Some travel banks may charge fees for certain transactions or account maintenance. | Usually offers low or no fees, depending on the bank. |

| Ease of Use | Designed for travel planning and booking, often with user-friendly interfaces. | Requires separate planning and booking processes. |

| Security | Generally secure, but it’s essential to choose a reputable travel bank. | Highly secure, with FDIC insurance protecting your deposits. |

| Family Benefits | Can offer family-friendly rewards, such as discounts on family travel packages. | No specific family travel benefits. |

| Interest Rates | May not offer interest or offer lower interest rates compared to savings accounts. | Offers interest, which can help your savings grow over time. |

| Financial Planning | Integrated with travel planning, making it easier to allocate funds for specific trips. | Requires separate financial planning to allocate savings for travel. |

| Earning Potential | Potential to earn more value through rewards and bonuses compared to the interest earned in a savings account. | Limited to interest earned, which may not keep pace with inflation or travel costs. |

| Accessibility | Accessible through travel platforms or apps, making it convenient for booking and managing travel. | Accessible through bank branches, ATMs, and online banking platforms. |

| Savings Growth | Savings grow through deposits and rewards earned from travel-related activities. | Savings grow through interest earned over time. |

| Trip Customization | Tailored for travel, with features like price tracking, itinerary planning, and travel insurance options. | Requires separate planning and arrangements for travel insurance and itinerary customization. |

| Long-Term Planning | Suitable for families planning multiple trips or frequent travel. | Suitable for long-term savings goals, including travel if planned separately. |

| Liquidity | Funds are typically designated for travel, limiting their use for other purposes. | Funds are readily accessible for any expense, providing greater liquidity. |

| Risk | Risk associated with the stability of the travel provider or platform. | Low risk due to FDIC insurance and established banking systems. |

| Convenience | Streamlined travel booking and management within the travel bank platform. | Requires separate booking and management processes outside of the savings account. |

| Spending Habits | Encourages disciplined spending on travel-related expenses. | Allows for flexible spending but requires self-discipline to allocate funds for travel. |

| Emergency Access | May have limited access to funds for emergencies outside of travel. | Provides easy access to funds for emergencies or unexpected expenses. |

| Family Financials | Centralized system for family travel funds, making it easier to track and manage collective savings. | Requires manual tracking and allocation of funds for family travel expenses. |

| Travel Preferences | Aligned with travel preferences, such as earning miles on specific airlines or points at preferred hotel chains. | Not directly aligned with travel preferences, offering general savings for any travel option. |

| Goal Setting | Facilitates clear travel goal setting with specific targets for destinations and experiences. | Requires separate goal setting and allocation of savings for travel. |

| Financial Literacy | Opportunity to teach children about budgeting and saving for travel goals. | Requires separate education on financial literacy and saving for travel. |

9. How Can a Travel Bank Help with Unexpected Travel Expenses?

A travel bank can be a lifesaver when unexpected travel expenses arise, providing a readily available source of funds to cover emergencies or unforeseen costs.

Managing Unexpected Expenses with a Travel Bank

- Emergency Fund: Use your travel bank as an emergency fund to cover unexpected costs such as flight cancellations, medical emergencies, or lost luggage.

- Flexibility: Easily access your funds to pay for unexpected expenses without disrupting your main budget.

- Peace of Mind: Knowing you have a dedicated source of funds for travel emergencies reduces stress and anxiety.

- Quick Access: Withdraw funds quickly and easily through your travel bank’s app or website.

- Insurance Coverage: Some travel banks offer travel insurance options to cover unexpected expenses.

- Budget Adjustments: Adjust your travel budget as needed to accommodate unexpected costs.

- Family Support: If traveling with family, a travel bank ensures everyone has access to emergency funds.

10. What Are Some Creative Ways to Fund My Travel Bank?

Funding your travel bank doesn’t have to be a chore. Get creative with these fun and effective ways to boost your travel savings.

Innovative Ways to Add Funds

- Sell Unused Items: Declutter your home and sell items you no longer need on online marketplaces.

- Freelance Work: Take on freelance gigs to earn extra money that can be deposited into your travel bank.

- Rent Out Your Home: Rent out your home or spare room on Airbnb while you’re away.

A day in the life of a travel blogger working on the road with TravelBank

A day in the life of a travel blogger working on the road with TravelBank

- Participate in Surveys: Earn rewards by participating in online surveys and deposit the earnings into your travel bank.

- Cash Back Apps: Use cash back apps to earn rewards on your everyday purchases.

- Cut Expenses: Identify areas where you can cut back on spending and allocate those savings to your travel bank.

- Set Up a Jar: Put all your spare change in a jar and deposit it into your travel bank regularly.

- Host a Garage Sale: Organize a garage sale to sell unwanted items and add the proceeds to your travel fund.

- Create a Travel Savings Challenge: Challenge yourself to save a certain amount each week or month.

- Use Travel Rewards Credit Cards: Maximize your spending by using credit cards that offer travel rewards.

11. What Are the Tax Implications of Using a Travel Bank?

Understanding the tax implications of using a travel bank is important for managing your finances and ensuring compliance with tax laws.

Tax Considerations for Travel Banks

- Rewards and Credits: Generally, rewards and credits earned through travel banks are not considered taxable income.

- Interest Earned: If your travel bank earns interest, that interest may be taxable and must be reported on your tax return.

- Business Travel: If you use your travel bank for business travel, you may be able to deduct certain expenses, subject to IRS guidelines.

- Consult a Tax Professional: For specific tax advice, consult with a qualified tax professional who can provide guidance based on your individual circumstances.

- Keep Records: Maintain accurate records of all transactions, including deposits, withdrawals, and rewards earned, for tax purposes.

- State Taxes: Be aware of state tax laws regarding travel rewards and credits.

- Form 1099-MISC: You may receive a Form 1099-MISC if you earn more than $600 in rewards or credits from your travel bank.

12. What Security Measures Should I Look for in a Travel Bank?

Ensuring the security of your travel bank is crucial to protect your funds and personal information from fraud and unauthorized access.

Essential Security Features

- Encryption: Look for travel banks that use encryption to protect your data during transmission.

- Two-Factor Authentication: Enable two-factor authentication to add an extra layer of security to your account.

- Fraud Monitoring: Choose a travel bank that actively monitors for fraudulent activity and alerts you to any suspicious transactions.

- FDIC Insurance: If your travel bank is a savings account, ensure it is FDIC-insured to protect your deposits.

- Secure Website and App: Verify that the travel bank’s website and app use secure connections (HTTPS) and have up-to-date security protocols.

- Regular Audits: Select a travel bank that undergoes regular security audits to identify and address potential vulnerabilities.

- Privacy Policy: Review the travel bank’s privacy policy to understand how your personal information is collected, used, and protected.

- Account Alerts: Set up account alerts to receive notifications about transactions, balance changes, and other account activity.

- Strong Passwords: Use strong, unique passwords for your travel bank account and update them regularly.

- Avoid Phishing: Be cautious of phishing emails and other scams that may attempt to steal your login credentials or personal information.

13. How Can I Teach My Kids About Saving for Travel with a Travel Bank?

Involving your kids in the process of saving for travel can teach them valuable financial literacy skills and make family vacations even more meaningful.

Tips for Teaching Kids About Travel Savings

- Set a Family Travel Goal: Involve your kids in choosing a destination and setting a savings goal.

- Create a Visual Savings Chart: Use a chart to track your progress towards your travel goal and make it fun for kids to see how much you’ve saved.

- Assign Chores: Give your kids chores to earn money that they can contribute to the travel bank.

- Match Their Savings: Offer to match a percentage of their savings to incentivize them to save more.

- Explain the Value of Money: Teach your kids about the value of money and how it can be used to achieve their goals.

- Let Them Make Decisions: Involve your kids in making decisions about the trip, such as choosing activities or restaurants, to give them a sense of ownership.

- Use a Kids’ Travel Bank: Consider using a separate travel bank account specifically for your kids’ savings.

- Celebrate Milestones: Celebrate milestones as you reach different savings goals to keep your kids motivated.

- Lead by Example: Show your kids how you save money for travel and involve them in the process.

- Make It Fun: Make saving for travel fun by incorporating games, challenges, and rewards.

14. What Are Some Common Mistakes to Avoid When Using a Travel Bank?

To make the most of your travel bank and avoid potential pitfalls, be aware of these common mistakes.

Common Mistakes to Avoid

- Not Setting a Budget: Failing to set a budget can lead to overspending and deplete your travel bank too quickly.

- Ignoring Fees: Overlooking fees for transactions, withdrawals, or account maintenance can eat into your savings.

- Not Maximizing Rewards: Not taking advantage of rewards programs and promotions can leave valuable credits on the table.

- Booking Last Minute: Waiting until the last minute to book can result in higher prices and fewer options.

- Not Comparing Prices: Failing to compare prices across different airlines, hotels, and travel platforms can cause you to miss out on better deals.

- Overlooking Restrictions: Not reading the fine print and understanding the restrictions on your travel bank can lead to frustration and disappointment.

- Not Tracking Expenses: Not tracking your expenses can make it difficult to stay on budget and manage your spending.

- Using the Travel Bank for Non-Travel Expenses: Using your travel bank for non-travel expenses defeats the purpose and depletes your travel fund.

- Not Securing Your Account: Neglecting to secure your account with strong passwords and two-factor authentication can leave you vulnerable to fraud.

- Not Reviewing Statements: Failing to review your statements regularly can allow errors or fraudulent activity to go unnoticed.

15. How Can I Integrate My Travel Bank with My Family’s Overall Financial Plan?

Integrating your travel bank with your family’s overall financial plan ensures that your travel savings align with your broader financial goals.

Integrating Travel Banks into Financial Planning

- Set Financial Goals: Define your family’s financial goals, including travel, retirement, education, and other priorities.

- Create a Budget: Develop a budget that allocates funds to different areas, including your travel bank.

- Prioritize Savings: Prioritize savings for travel based on your family’s values and goals.

- Automate Savings: Set up automatic transfers to your travel bank to ensure consistent savings.

- Review Regularly: Review your financial plan regularly to make sure it still aligns with your goals and adjust as needed.

- Consider Tax Implications: Factor in the tax implications of using a travel bank when making financial decisions.

- Consult a Financial Advisor: Seek advice from a financial advisor to help you create a comprehensive financial plan that includes your travel bank.

- Balance Travel with Other Goals: Ensure that your travel savings do not compromise other important financial goals, such as retirement or education.

- Involve Your Family: Involve your family in the financial planning process to ensure everyone is on board and working towards the same goals.

- Track Progress: Track your progress towards your financial goals, including your travel savings, to stay motivated and on track.

16. What Are the Latest Trends in Travel Banks and Family Travel?

Staying informed about the latest trends in travel banks and family travel can help you make the most of your vacation planning and savings.

Emerging Trends

- Personalized Travel Banks: Travel banks that offer personalized recommendations and travel planning services based on your preferences and budget.

- Subscription-Based Travel: Subscription services that provide access to exclusive travel deals and discounts in exchange for a monthly fee.

- AI-Powered Travel Planning: Travel apps and platforms that use artificial intelligence to help you plan and book your trips.

- Sustainable Travel: A growing emphasis on sustainable travel options, such as eco-friendly accommodations and activities.

- Multi-Generational Travel: More families are traveling with multiple generations, requiring travel banks to offer solutions for diverse needs and preferences.

- Wellness Travel: An increasing focus on wellness travel, with travel banks offering options for spa retreats, yoga retreats, and other wellness activities.

- Remote Work Travel: The rise of remote work has led to more families traveling while working, requiring travel banks to offer flexible booking and cancellation policies.

- Contactless Travel: A greater emphasis on contactless travel experiences, such as mobile check-in and digital payments.

- Virtual Reality Travel: The use of virtual reality to preview destinations and experiences before booking.

- Travel Banks Integrated with Loyalty Programs: Seamless integration between travel banks and loyalty programs, making it easier to earn and redeem rewards.

17. How Can Familycircletravel.net Help Me Plan My Next Family Trip Using a Travel Bank?

At familycircletravel.net, we’re dedicated to providing you with the resources and information you need to plan unforgettable family vacations.

Resources and Support at Familycircletravel.net

- Destination Guides: Explore our comprehensive destination guides to find the perfect spot for your next family adventure.

- Travel Tips: Get expert travel tips and advice on everything from packing to budgeting to staying safe on the road.

- Accommodation Reviews: Read reviews of family-friendly hotels, resorts, and vacation rentals to find the perfect place to stay.

- Activity Recommendations: Discover fun and engaging activities for kids of all ages.

- Budgeting Tools: Use our budgeting tools to create a realistic travel budget and track your expenses.

- Travel Bank Recommendations: Find the best travel bank options for your family’s needs.

- Community Forum: Connect with other families and share your travel experiences and tips.

- Personalized Recommendations: Get personalized travel recommendations based on your preferences and budget.

- Booking Assistance: Receive assistance with booking flights, hotels, and other travel services.

we identified content that is frequently edited and added in shortcuts to increase productivity

we identified content that is frequently edited and added in shortcuts to increase productivity

- Travel Insurance: Find information on travel insurance options to protect your family from unexpected events.

Ready to start planning your next family adventure? Visit familycircletravel.net today to explore our destination guides, read expert travel tips, and find the perfect travel bank for your needs. Let us help you create unforgettable memories with your loved ones.

FAQ About Travel Banks

1. What is a travel bank?

A travel bank is a dedicated fund or account where you save money, points, or credits specifically for travel expenses, helping you manage and allocate your travel funds efficiently.

2. How does a travel bank work?

You deposit funds, transfer points, or earn credits into your travel bank, centralizing your travel savings for easy tracking and allocation when booking flights, hotels, or other travel services.

3. What are the benefits of using a travel bank for family travel?

Travel banks simplify budgeting, centralize funds, offer rewards and savings, provide flexible planning, and ensure transparency in your travel spending, making family vacations less stressful and more enjoyable.

4. What types of travel banks are available?

Common types include airline travel banks, hotel travel banks, credit card travel banks, third-party travel banks, employer travel banks, DIY travel banks, and subscription-based travel banks.

5. How can I create a travel bank for my family?

Choose a platform, open an account, set a budget, automate savings, earn rewards, track your progress, and use your travel bank to book travel services.

6. What are the best travel bank options for families?

Top choices include the Capital One Venture Rewards Credit Card, Chase Sapphire Preferred Card, American Express Membership Rewards Program, Delta SkyMiles Program, and Hilton Honors Program.

7. How can I maximize my travel bank savings?

Use a rewards credit card, take advantage of promotions, book during off-peak seasons, set price alerts, bundle travel services, stay loyal to brands, and redeem points wisely.

8. What are the key features to look for in a travel bank?

Essential features include flexibility, a rewards program, low fees, price alerts, budgeting tools, a mobile app, customer support, security, and transfer options.

9. How do travel banks compare to traditional savings accounts for travel?

Travel banks offer travel-specific rewards and tools but may be less flexible than traditional savings accounts, which provide greater liquidity and FDIC insurance.

10. How can a travel bank help with unexpected travel expenses?

Travel banks serve as an emergency fund, offering quick access to funds for unexpected costs without disrupting your main budget, providing peace of mind during travel.